Share this Post

Need help with your money or investments? Book a consultation to learn more about working together.

The Power of Long-Term Thinking: Why Retirees Should Avoid Market Timing

Retirement is a time when the focus generally shifts from earning a paycheck to ensuring that the savings and investments you have accumulated over your lifetime will last for the rest of your life. As a retiree, a critical financial goal is to preserve your wealth while generating enough income to sustain your lifestyle. However, this transition also brings with it a common dilemma: how to approach investing in a way that balances growth and security. There are two core elements to this: 1) your investment strategy and 2) your mindset. I'll cover the former in a separate article. The focus of this article is mindset.

One of the biggest mindset mistakes retirees can make is trying to "time" the market – that is, attempting to predict the ups and downs of the stock market in order to buy low and sell high. While it may sound appealing, market timing is a strategy that rarely works in the long run, and it can introduce unnecessary risks into your retirement portfolio.

In this article, we'll explore why retirees should embrace a long-term mindset when it comes to investing, and why attempting to time the market can be a dangerous path to follow.

Why Market Timing Doesn’t Work

Market timing involves trying to predict the future direction of the stock market, making investment decisions based on those predictions. For example, a person might sell all their stocks when they believe the market is about to decline, or they might buy stocks based on the expectation of a market rally. In theory, market timing seems like an appealing strategy – after all, who wouldn’t want to buy low and sell high?

However, research consistently shows that trying to time the market is extremely difficult, even for professional investors. There are a few reasons why market timing generally leads to poor investment outcomes:

1. The Market is Unpredictable

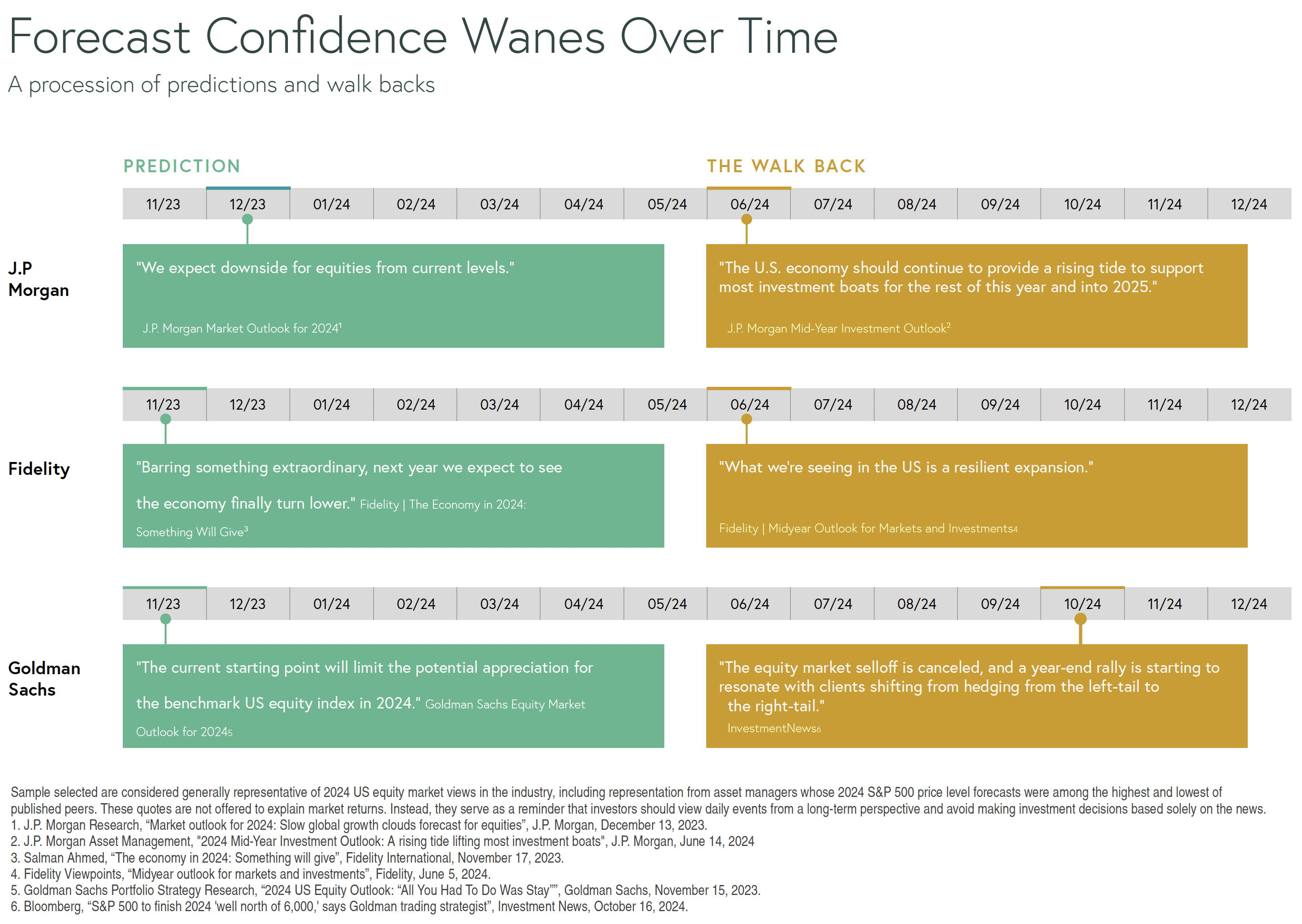

The primary reason why market timing fails is that predicting the movements of the stock market is incredibly difficult. Stock prices are influenced by a myriad of factors, including economic data, corporate earnings, geopolitical events, and investor sentiment. Some of these factors are completely unpredictable, and even experienced analysts often fail to accurately forecast market movements.

For instance, investors might expect a market downturn due to signs of an economic slowdown, but instead, the market continues to rise as positive earnings reports, or unexpected geopolitical events shift investor sentiment. Similarly, a global crisis like the COVID-19 pandemic can trigger a market crash that no one saw coming, but the market may quickly recover, catching those who tried to time it off-guard.

2. Missed Opportunities

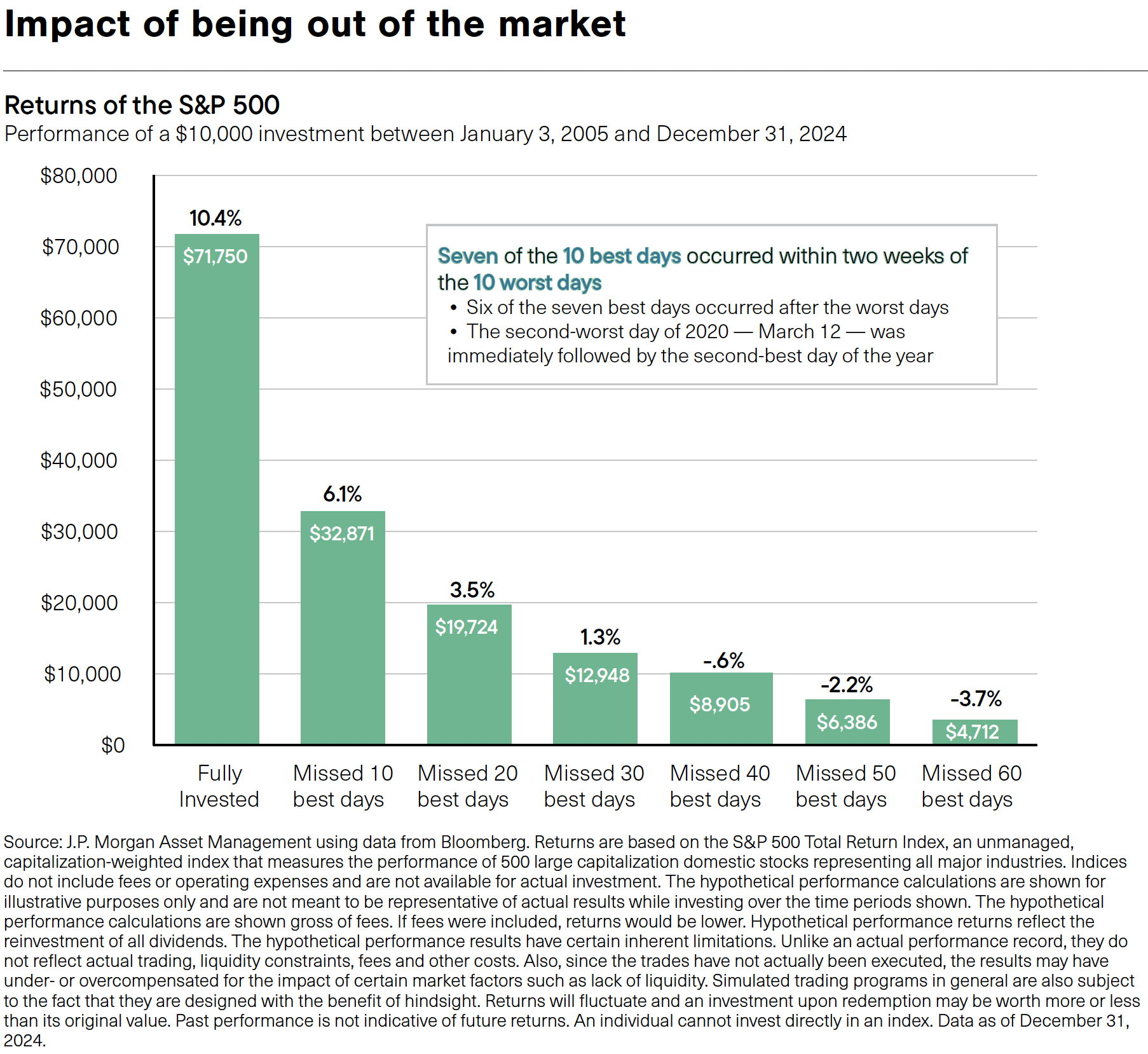

Another key downside of market timing is the risk of missing out on the best days in the market. The stock market tends to reward long-term investors who stay in the market through both the good times and the bad. However, some of the biggest gains in the market come during periods of volatility when investors may be tempted to sell out of fear.

For example, if you sell your investments because you believe the market is going to decline, you may miss the subsequent rally that could have significantly boosted your portfolio's value. A study by J.P. Morgan Asset Management found that missing just the best 10 days in the market over a 20-year period could reduce an investor’s returns by over 40% (see chart below). Further, seven of the 10 best days occurred within two weeks of the 10 worst day.

3. Emotional Decision-Making

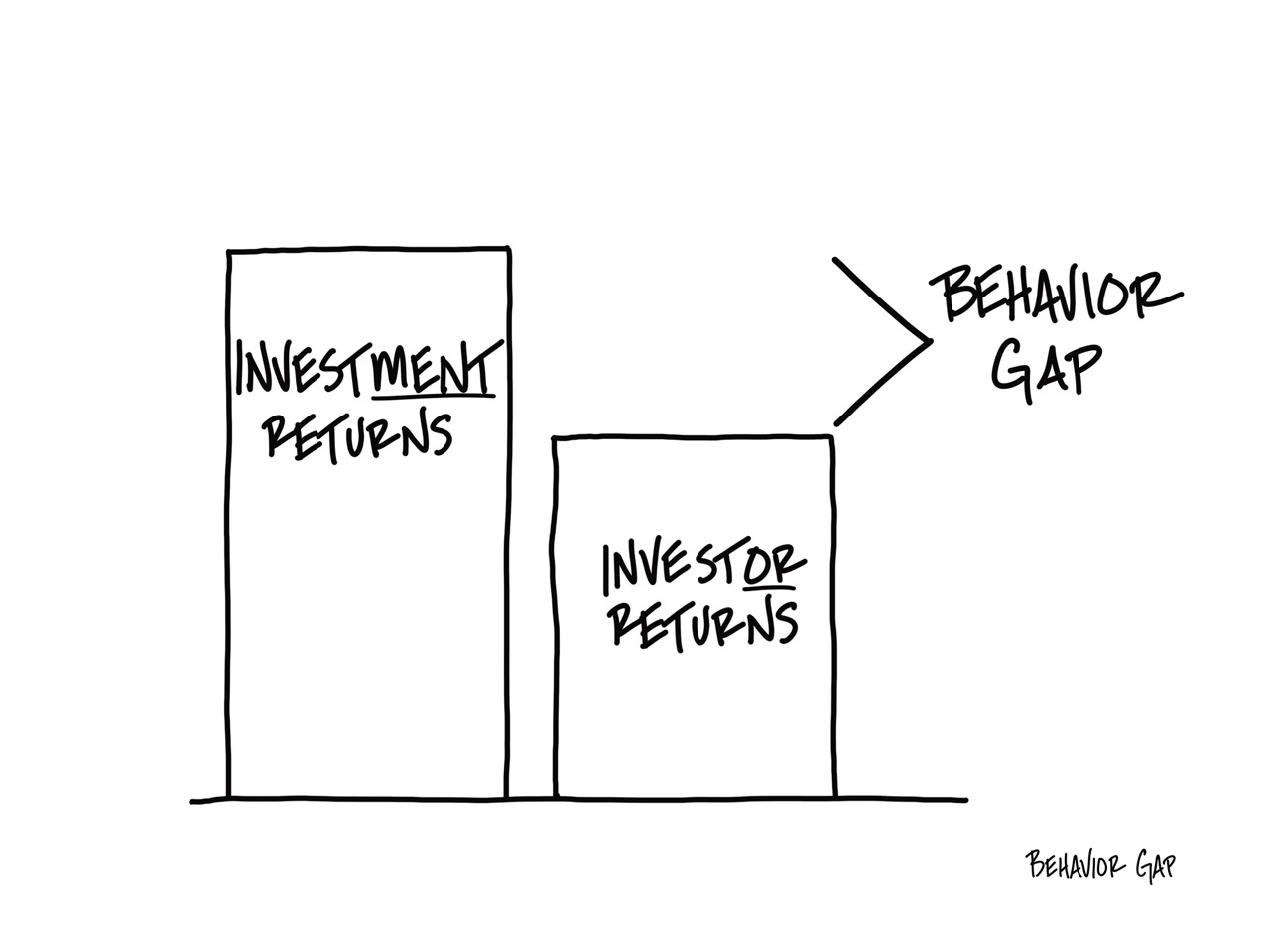

Market timing often involves making decisions based on emotions, such as fear and greed. When the market is volatile, it’s easy to panic and sell off investments to avoid further losses. Conversely, when the market is on an upswing, it’s tempting to pile into risky investments to chase returns. Emotional decision-making can lead to buying at high prices and selling at low prices – exactly the opposite of what you should be doing.

For retirees, who typically have a lower risk tolerance and fewer years to recover from losses, emotional decision-making can be especially damaging. A poorly timed sale of investments during a downturn could lock in losses, while buying into the market at an all-time high could expose your portfolio to significant risk.

Why a Long-Term Mindset is the Key to Success

Rather than trying to time the market, retirees are better off embracing a long-term investment strategy. Here’s why/how:

1. Compounding Growth

One of the most powerful concepts in investing is compounding, which refers to the ability of an investment to generate earnings that are then reinvested to generate even more earnings. The longer you leave your money invested, the more time it has to grow and compound. By adopting a long-term mindset, retirees give their investments the time they need to weather the inevitable market fluctuations and likely produce the best returns.

2. Staying the Course During Market Volatility

The stock market will inevitably experience periods of volatility – whether it’s a market correction, a recession, or even a global crisis. Retirees who adopt a long-term mindset understand that market fluctuations are normal and that staying invested through these periods is often the best strategy.

During times of volatility, it can be tempting to sell off investments to avoid further losses. But history has shown that markets tend to recover over time. For instance, the S&P 500 has experienced several significant downturns throughout its history, including the dot-com crash, the global financial crisis, and the COVID-19 pandemic. Despite these setbacks, the market has always rebounded, and long-term investors who stayed the course were rewarded with strong returns over time.

3. Diversification and Risk Management

A long-term investment strategy typically involves building a diversified portfolio that includes a mix of stocks, bonds, and other assets. Diversification helps manage risk by spreading investments across different asset classes, industries, and geographies. By holding a diversified portfolio and staying invested over the long term, retirees can reduce the impact of short-term market fluctuations on their overall portfolio.

Rather than trying to time individual investments, a diversified portfolio allows retirees to focus on the overall asset allocation that aligns with their goals and risk tolerance. A long-term approach also allows you to take advantage of the power of rebalancing – adjusting the mix of assets in your portfolio as market conditions change, without trying to predict those changes.

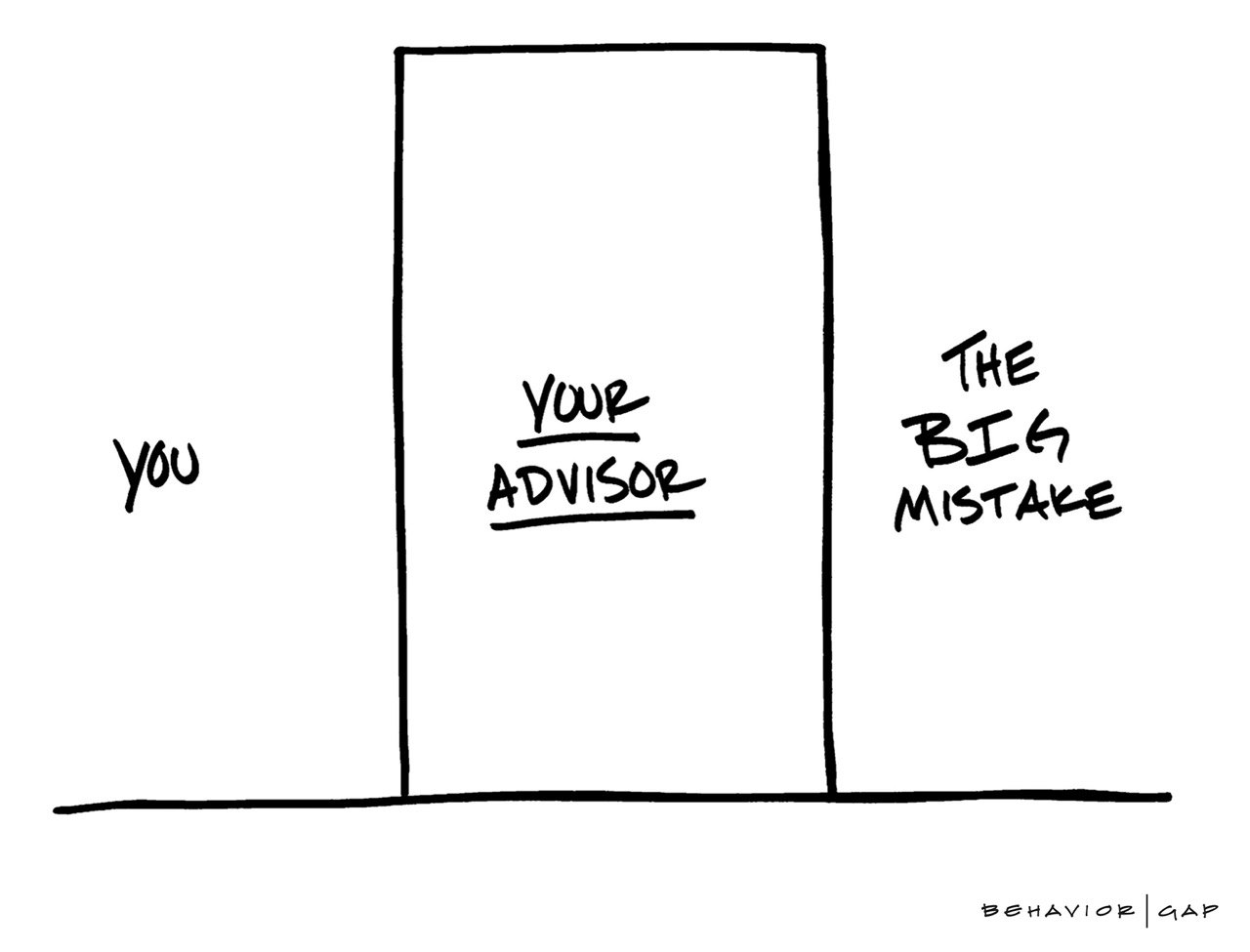

4. Work With Your Trusted Advisor

While the concept of having a long-term investing mindset is simple, the reality is that it is not easy for most people. The financial media likes to focus on the negative and when the market is not doing well, they double-down on their negativity. This can make it extremely difficult emotionally.

This is where having the right financial advisor for your situation really matters. The value of a good fiduciary financial advisor can far exceed their fee, as their expertise can help you avoid costly mistakes, optimize investments, reduce taxes, and create and maintain a personalized retirement plan—ultimately saving you money and providing peace of mind. Warren Buffett once said: "Price is what you pay, value is what you get."

Conclusion

For retirees, the key to successful investing lies not in trying to predict the market’s movements, but in adopting a long-term mindset that emphasizes patience and discipline. By focusing on long-term goals and avoiding the temptation to time the market, retirees can better manage risk, capture the benefits of compounding, and maximize the chances of achieving a secure and sustainable retirement.

Remember, it’s not about timing the market – it’s about time in the market. By staying the course and maintaining a long-term perspective, retirees can weather market volatility and grow their wealth over time, allowing them to enjoy the retirement they’ve worked hard to achieve.

Navigating the financial markets as you near retirement can feel daunting. If you need help evaluating your options and want guidance from a CERTIFIED FINANCIAL PLANNER™, schedule a free consultation with us. We are based in New Braunfels, TX but serve clients virtually, nationwide.

Important Disclosure: This article is for educational use only. It should not be considered financial or investment advice. Please consult your financial advisor about your specific situation. Past performance is no guarantee of future results.